Bitcoin (BTC), the world’s largest cryptocurrency by market cap is gaining significant attention from crypto enthusiasts following its impressive performance. Today, December 17, 2024, a prominent crypto expert made a post on X (previously Twitter) that whales have purchased a significant 70,000 BTC worth nearly $7.30 billion.

Bitcoin Whales’ Rising Interest

This notable BTC purchase was made over a 48-hour period, during which BTC experienced an impressive upside rally and marked a new high today. However, the current market sentiment seems quite confusing, as BTC and only a few major assets are experiencing upside momentum, while the majority are struggling to gain traction.

Current BTC Price Momentum

With this massive purchase, BTC reached a new high of $108,353 today. At press time, BTC is trading near $107,850 and has experienced a price surge of over 2.25% in the past 24 hours. During the same period, its trading volume increased by a modest 8%, indicating heightened participation from traders and investors amid the ongoing bull run.

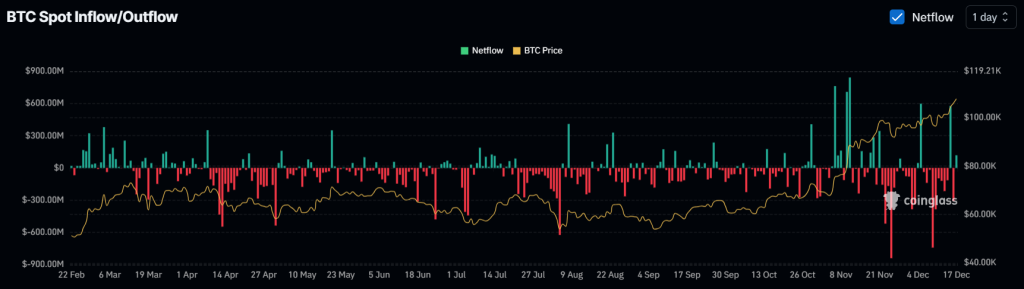

$117 Million in BTC Inflow

Despite notable participation and whale acquisitions, data shows that some long-term holders continue to dump their holdings onto exchanges, as reported by the on-chain analytics firm Coinglass. Data from Bitcoin spot inflow/outflow revealed that exchanges have witnessed a significant $117.66 million worth of BTC inflow.

This inflow refers to the transfer of assets from the long-term holder’s wallet to the exchanges, which suggests potential selling pressure and a possible price decline in the coming days. However, the recent accumulation is significantly higher than the inflow, which suggests that this won’t impact the BTC price.

Why is the BTC Price Increasing?

Besides the recent accumulation by whales, demand from institutions has skyrocketed as of December 16, 2024. Major firms like MicroStrategy and Semler Scientific acquired 15,350 BTC and 211 BTC, respectively, as reported by CoinPedia.

The acquisitions by these whales and institutions could be a potential reason behind the ongoing bull run.

Credit:Source link